Direct Tax Alert

Direct Tax Alert

CBDT issues additional guidelines on TDS by E-Commerce operators under section 194-O of the IT Act

BACKGROUND

Finance Act 2020 introduced Section 194-O to the Income Tax Act, 1961 (IT Act) to bring e-commerce transactions under the tax net. Section 194-O of the IT Act provides that an e-commerce operator1 is required to deduct tax (TDS) for the sale of goods or provision of services made by an e-commerce participant2 which is facilitated by such an e-commerce operator through its digital facility. Tax should be deducted at the time of credit of the amount of sale of goods or provision of services to the account of an e-commerce participant or at the time of making a payment to an e-commerce participant by any other mode, whichever is earlier.

Section 194-O(4) of the IT Act empowers the Central Board of Direct Taxes (CBDT) to issue guidelines for removing difficulties in reference to the interpretation and applicability of the provisions. In this regard, CBDT in the past had issued guidelines3 and provided clarification on several aspects. However, owing to representations received to provide further clarifications, recently, the CBDT has issued a Circular4 and provided the following guidelines. We at BDO in India, have hereunder analysed and summarised key provisions of the said circular and provided our comments on its impact hereunder:

TDS in case of multiple e-commerce operators

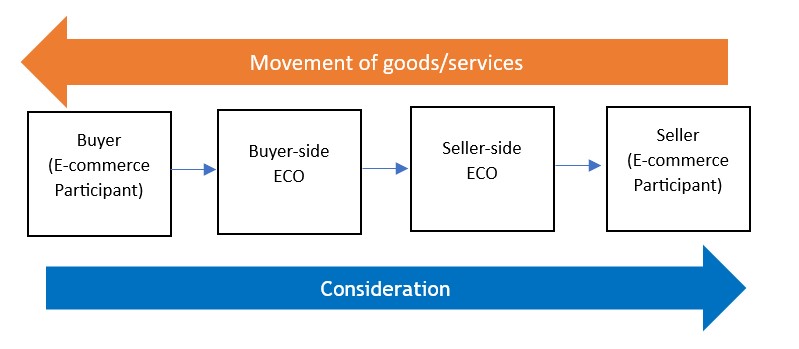

With the rapid advancement of the e-commerce industry, there may be instances whereby e-commerce transactions are carried out on a platform or network (e.g. the Open Network for Digital Commerce) on which multiple e-commerce operators are participating in a single transaction. For example, there could be a buyer-side e-commerce operator (ECO) involved in buyer-side functions and a seller-side ECO involved in seller-side functions. In this case, there may be two situations:

Situation-1 Multiple ECOs are involved in a single transaction and the seller side ECO is not the actual seller of the goods or services.

CBDT clarifies that the ECO who finally makes the payment or the deemed payment to the seller for goods or services provided (i.e. Seller-side ECO) must deduct TDS of 1% on the gross amount of sale of goods or services provided.

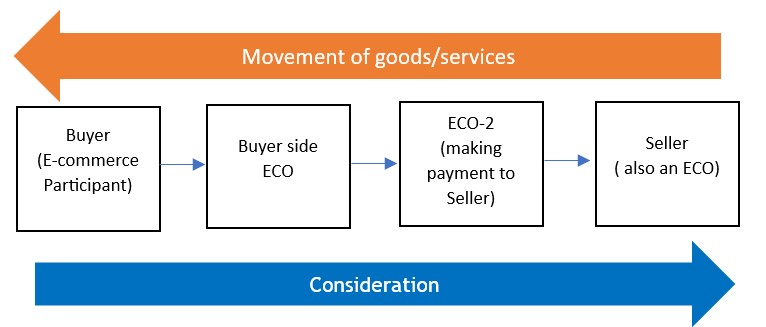

Situation-2 Multiple ECOs are involved in a single transaction and the seller-side ECO is the actual seller of the goods or services.

Situation-2 Multiple ECOs are involved in a single transaction and the seller-side ECO is the actual seller of the goods or services.

On the buying side, an ECO could be providing an interface to the buyer and on the selling side, the seller itself is an ECO and is directly interacting with an ECO.

CBDT clarifies that ECO who finally makes the payment or the deemed payment to the seller for goods or services provided (i.e. ECO 2) must deduct TDS of 1% on the gross amount of sale of goods or services provided.

CBDT clarifies that a TDS of 1% must be deducted from the “gross amount” invoiced to the buyer. This amount can include any charges levied by the seller as well as the buyer side and seller side ECO. Conversely, the amount which is not invoiced to the buyer by the seller does not form part of the “gross amount”.

Illustration 1:

- The seller will issue an invoice for INR 118 (i.e. INR 100+5+10+2+1) to the buyer. The shipping fees, packaging fees and convenience fees are separately charged to the buyer to provide services in relation to the main supply.

- Therefore, TDS under section 194-O of the IT Act needs to be deducted by the seller side ECO at the time of payment (including deemed payment) or credit on INR 118 since this is the gross amount of sales.

Further, payments made to the platform or network provider for facilitating the transaction would form part of the “gross amount” for the purposes of TDS under section 194-O of the IT Act if they are included in the payment for the transaction. However, if these payments are being paid on a lump-sum basis and are not linked to a specific transaction, then these need not be included in the “gross amount”.

Illustration 2:

A buyer purchases goods with a label price of INR 85 from the seller. The seller-side ECO’s fee (for listing the Seller catalogue and facilitating the transaction) is INR 10 and the buyer-side ECO’s fee (to provide an interface to enable the buyer to discover the seller/product and to enable them to place an order) is INR 5. The Seller charges the buyer a total of INR 100 (INR 85+10+5) and issues an invoice for INR 100 (gross amount).

- The TDS under section 194-O of the IT Act will be calculated on INR 100 (gross invoice value) at 1% and the responsibility of withholding and depositing it would be on the seller ECO.

- Further, the buyer and seller ECO’s fees will not be subject to further TDS (say TDS on Commission under section 194H) barring TDS on virtual digital assets under section 194S of the IT Act.

- The principles applied by CBDT in this Circular is similar to Circular No. 13 of 2021 which pertains to TDS on purchase of goods.

- The CBDT has clarified that in situations where GST or any other levy is indicated separately in the invoice and tax is deducted at the time of credit of the amount in the account of the seller, the same must not be included while calculating “gross amount” for deduction of TDS under section 194-O of the IT Act.

- However, if TDS is deducted on a payment basis because payment is earlier than the credit, then TDS must be deducted on the whole amount i.e. inclusive of GST or any other tax levy.

-

The principles applied by CBDT in this Circular is similar to Circular No. 13 of 2021 which pertains to TDS on purchase of goods.

- The CBDT has clarified that where any purchase return has taken place and TDS has already been deducted and deposited by the e-commerce operator on such transaction then TDS may be adjusted against the next purchase by the deductor with the same deductee in the same Fiscal Year.

- Further, no adjustment is required if the purchase-return is replaced.

Seller Discount-

- The CBDT clarifies that in instances where discounts are given by the seller (E-commerce participant) then such amount would be reduced from the “gross amount” for the purpose of TDS under section 194-O of the IT Act.

- For example, if the label-price of a product is INR 100, and the seller offers a discount of INR 10, INR 90 will be receivable from the buyer. In this case, the seller will invoice the buyer for INR 90 and hence TDS will be calculated on INR 90.

Buyer ECO or Seller ECO discount-

- In instances where a discount is given by the buyer ECO/seller ECO, usually the seller receives full consideration of the product. Thus, in such instances, the TDS must be deducted from the “gross amount” without giving effect to the discount offered by such ECOs.

- For example, if the price quoted by the seller is INR 100 and the buyer ECO gives a discount of INR 10, INR 90 (i.e. 100-10) will be collected from the buyer and remitted to the seller, and the buyer ECO will pay the remaining INR 10 to the seller via seller ECO. The invoice on the buyer will be raised for INR 100 and tax will be deducted by the seller-side ECO on INR 100, which is the gross amount of sales.

BDO IN INDIA COMMENTS

This is a welcome move by CBDT since it provides much required clarity in case where e-commerce transaction is taking place on platforms like Open Network for Digital Commerce5(ONDC) and more than one ECO is involved.

1 e-commerce operator is a person who owns, operates or manages a digital or electronic facility or platform for electronic commerce.

2 e-commerce participant means a person resident in India selling goods or providing services or both, including digital products, through digital or electronic facilities or platforms for electronic commerce.

3 Circular No. 17/2020, dated 29 September 2020.

Circular No. 20/2021, dated 25 November 2021. Please refer to our tax alert-

4 Circular No. 20/2023, dated 28 December 2023.

5 ONDC was founded by the Department for Promotion of Industry and Internal Trade (DPIIT) of Government of India to develop e-commerce.