Professional services companies add record partners as business booms

Professional services companies add record partners as business booms

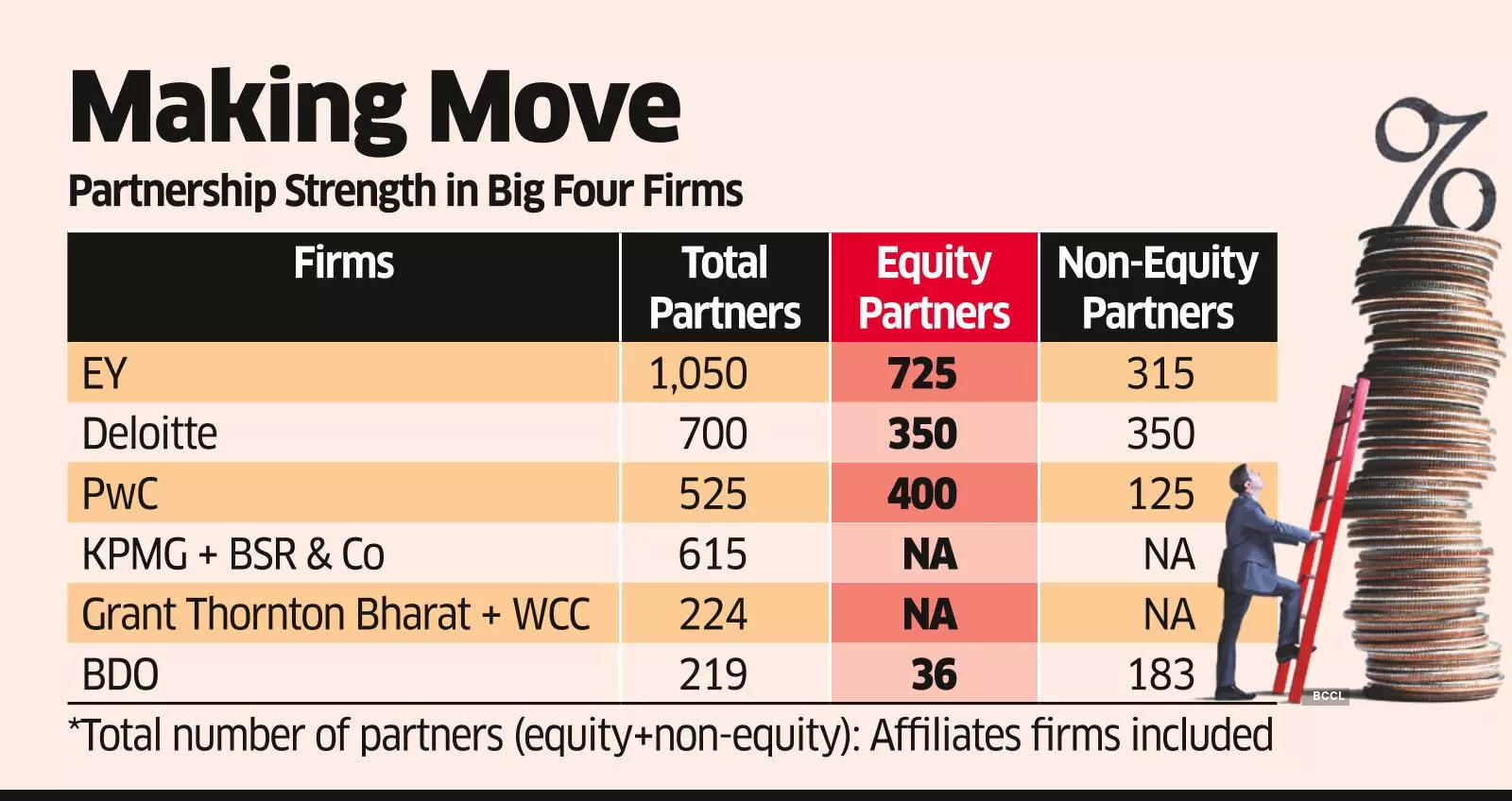

Mumbai: The top six professional services firms in India combined now have over 3,300 partners - equity plus non equity - with EY being the first firm to exceed 1,000 partner benchmark driven by continued strong growth in advisory businesses after the Covid-19 disruption.

In the last three years, the advisory businesses - consulting, deals and risk - have grown much faster - 25% plus-than the traditional areas like audit and tax, which have grown between 15% and 22% for most firms, as the firms continue to pivot towards high-growth advisory services, including tech consulting and implementation.

With EY being the last Big Four firm to close its financial year on June 30, the combined revenue of the Big Four firms - affiliates included - in the last financial year has crossed ₹39,000 crore, according to multiple senior partners ET spoke to across firms.

With growing demand for services due to increased economic activity, growing regulatory complexity, rapid tech-led disruption and increasing digitisation, the firms have been forced to expand their middle and top level leaderships, hence the record partner additions, particularly in consulting and tech consulting.

In FY 23-24, Deloitte promoted and laterally hired around 150 partners. Just to put things in perspective, in 2014, the firm had 173 partners in all. Rival firm PWC internally promoted or laterally hired more than 100 partners, while KPMG added 29 partners in FY24.

"The country's growth trajectory empowers us to cultivate new leaders and drive groundbreaking innovation from India. Deloitte is currently the fastest-growing large firm in India and we are significantly expanding our partnership due to robust demand for our services. We are building innovation not just for India, but for the world," said Romal Shetty, CEO, Deloitte South Asia.

Sanjeev Krishan, chairman, PwC India, said the firm has been able to elevate partners based on two basic principles: having the right people who are focused on making an impact for clients and being an aspirational partnership for our people and fellow partners.

"To stay ahead in the business critical fields of AI, business model reinvention, climate and sustainability, cyber, tax and trust, we have strategically invested in the acquisition and development of top-tier leadership talent," he said.

The senior partners estimated the total partner profit pool in FY24 for the Big Four firms, including audit affiliates, could be between ₹6,600 crore and ₹7,000 crore.

It's not just the Big Four firms; two other firms, Grant Thornton (GT) and BDO, have also scaled up quickly in the last three years and registered strong partner growth.

Grant Thornton Bharat and its associate audit firm, Walker Chandiok & Co, now have 224 partners, having added 59 new partners in the new financial year between them. "GT Bharat is already considered the first Indian Big Four - both clients and talent are now attracted to that Indian-global proposition, something we have been promoting now for 25 years," said Vishesh Chandiok, CEO, Grant Thornton Bharat.

Mumbai-based BDO has been the other non-Big Four success story, having scaled up from 15 partners a decade ago to 219 now.

"There was a clear need for a firm like BDO in a growing economy like India. Companies were looking for a non-Big Four quality firm. We took risks and invested money ahead of the opportunity, and now we will cross 10,000 people in August," said Milind Kothari, CEO of BDO, India's sixth-largest professional services company.

The future pipeline for partnerships is also robust for the firms. Deloitte has over 200 executive directors (EDs) with over 150 being promoted or laterally hired in FY 2024. At PwC the partner pipeline for the next year is 100 plus and new ED promotions too - currently 280 - will cross 110.

The partner title is widely sought after in the professional service firms and each firm strives to broaden its partnerships as it's a flex before clients, it encourages staff and raises the company profile.

With large staff bases, thousands of top Big Four performers increasingly aim to become partners in a short period of time, and to meet their ambitions, the firms created tiers such as paid partners, associate partners, and, in certain cases, senior executive directors are also given partner-like treatment.

Now, firms are accelerating career progression, but differences in nomenclature, such as how each firm treats their EDs, can sometimes distort numbers. However, the traditional benchmark of having one non-equity partner for every three equity partners is clearly no longer effective, as firms are now adding non-equity partners at a faster rate, and hiring much bigger numbers from industry.

Recently, one leading firm has informed its 350 non-equity partners that they will be made equity partners over three years, according to sources with direct knowledge of the matter. PwC, with 125 salaried partners and 280 EDs, considers them part of its extended partner catchment pool.

Source:- Economic Times