Rationalisation of TDS provisions in Union Budget 2024

Rationalisation of TDS provisions in Union Budget 2024

Additionally, the Finance Minister has proposed to provide a Standard Operating Procedure (SOP) for TDS defaults and simplify the compounding guidelines for such defaults.

With the aim of simplifying tax procedures, the Finance Minister has proposed the rationalisation of certain TDS provisions. This proposal is a step towards easing compliances for taxpayers, benefitting both taxpayers and the income-tax department.

Additionally, the Finance Minister has proposed to provide a Standard Operating Procedure (SOP) for TDS defaults and simplify the compounding guidelines for such defaults.

Withholding tax on payments to Partners of a partnership Firm/ Limited Liability Partnership (LLP)

-

Currently, there are no provisions requiring a Firm/ LLP to deduct tax on payments such as salary, remuneration, interest, bonus, or commission to its partners.

-

It is proposed to introduce a new section 194T, with effect from 01 April 2025, imposing TDS at a rate of 10% on aggregate amounts paid to Partners exceeding INR 20,000 in a financial year.

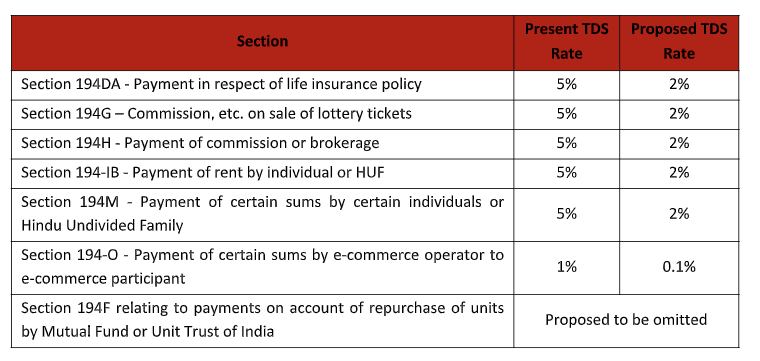

Reduction of rate from 5% to 2%

Effective 01 October 2024, it has been proposed to bring down TDS rates from 5% to 2% under certain

sections, and omit section 194F where the TDS rate is 20%, as outlined below:

The table of amendment to TDS rates in memorandum to Finance Bill (No. 2), 2024, also includes section 194D, wherein it is proposed to reduce TDS rate from 5% to 2%. However, the corresponding amendment does not appear in the Finance Bill. This is expected to be rectified before the Bill is passed in the Parliament.

Clarification on the scope of TDS on immovable property

-

There have been instances where taxpayers interpreted the provisions of section 194-IA to mean that the threshold limit of INR 50 lakh applies to each individual buyer rather than the total consideration paid for the property.

-

To remove this ambiguity, it is now clarified that the limit of INR 50 lakh as provided under section 194-IA, would be applicable to the total sales consideration or stamp duty value of the immovable property, irrespective of the number of sellers and buyers involved.

TDS/ TCS credit in payroll tax calculation

-

Section 192 of the Act mandates TDS on salary income. Further, sub-section (2B) of section 192 requires employers to consider income earned by employees under any other heads and any tax deducted thereon for calculating TDS on salary, subject to certain conditions.

-

With the increase in the scope of applicability of TCS, many salaried taxpayers have become subject to it. Representations have been received requesting that credit for TCS paid should be allowed while computing TDS on salary income, which will help avoid cash flow issues for employees. Similarly, all TDS should be taken into account for the purpose of deduction of tax from the employees’ salary income.

-

Therefore, it is proposed to permit the credit of all such TCS and TDS while computing TDS on salary income under section 192.

Expansion in the scope of lower rate of TDS

To facilitate ease of doing business and offer taxpayers the option to seek a lower tax rate to reduce compliance burden, it is proposed to allow for the application of lower deduction/ collection certificate of tax for section 194Q (TDS on payment for purchase of goods) and sub-section (1H) of section 206C (TCS on receipt of sale of goods).

Conclusion

The scope of TDS is proposed to be expanded to include remuneration of partners of a firm, which was hitherto outside of its ambit.

The clarification regarding TDS on purchase of immovable property in section 194-IA will address loopholes that led to the non-deduction of tax in certain cases.

Granting TDS/ TCS credit on other items against TDS liability on salary will provide much-needed relief to the salaried class, easing the burden of payment of excess tax payment on one hand and refund claims on the other.

Additionally, including section 194Q under the purview of section 197 would reduce the blockage of funds.

Source:- BFSI Economic Times